Explain the Different Types of Commercial Banks

These banks also engage in business banking and loans. Deposits Offered by Commercial Banks.

Types Of Bank Commercial Bank Business And Economics Investment Banking

They have brief loan terms of just 6 to 24 months.

. Commercial banks are classified into two categories ie. In a demand loan account the entire amount is paid to the debtor at one time either in cash or by transfer to his savings bank or. Bank accounts are private accounts used by banks to store funds for a particular entity such as a business or individual.

In India commercial banks are divided into three groups. Investment banks help businesses raise capital in financial markets. Here the quantity of exchanges you can make every View the full answer.

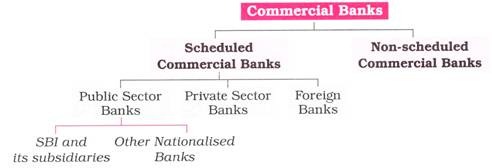

These are governed by the State Cooperative Societies Act. Further scheduled commercial banks are further classified into three types. They are as follows.

Each country has a central bank that regulates all the other banks in that. Types of Bank Accounts in Commercial Banks By Tyler Lacoma Bank accounts allow customers to save or withdraw funds. Commercial banks while providing loans to businesses consider various factors such as nature and size of business financial status and profitability of the business and its ability to repay loans.

Deposit Type 1. A Public sector banks where the majority of the capital is held by the government such as Bank of India State Bank of India etc. The checking account is another familiar inclusion in commercial bank accounts which is fundamentally different from a savings account.

Fixed Deposit Scheme 5. The most common types of commercial banks include checking deposit and savings banks with many of these activities offered at a single institution. -These banks accept the deposits from the general public and provide short term loans to traders manufacturers and businessmen by way of cash credits overdrafts and etc.

Regional Rural Banks RRB Local Area Banks LAB. Scheduled commercial banks and non-scheduled commercial banks. The Commercial banks give different types of loans and advances to the businessmen like Cash Credits Overdrafts Loans Discounting Bills.

A Public Sector Banks. Commercial banks which are also called business banks or corporate banks manage payments for customers provide lines of credit to manage cash flow and offer foreign exchange services for companies that do business overseas. B Private sector banks are owned by a group of individuals such as AXIS bank HDFC bank etc.

Answer to Explain the different types of services provided by commercial banks Dhaka Bank Prime Bank in Bangladesh nowadays. Housing Development Finance Corporation HDFC Bank. When the private individuals own more than 51 of the share capital then that banking company is a private one.

These accounts do not physically exist in the same way that safety deposit boxes do and banks actually use. When a loan is granted for a fixed period exceeding three. Lis any difference between the services o SolutionInn.

That urgency means that hard money loans carry interest rates as high as 10 to 18 in addition to costlier up-front fees. They accepts deposits from the public and lend money. These banks also render other services such as collecting and supplying information about the foreign customers providing remittance facilities etc.

When listing the types of commercial banks accounts the savings account is one of the account types that comes to. Types of Commercial Banks. Agricultural Development Bank of Zimbabwe Ltd Steward Bank EcoBank Limited Zb Bank Limited These are the examples of the types of Commercial banks they are not all listed here just to mention a few.

These loans act as investments of the commercial banks intending to earn profit. Industrial Credit and Investment Corporation of India ICICI Bank. The Reserve Bank of India is the central bank of our country.

This article throws light upon the top five types of deposits offered by commercial banks. These loans does not require any collateral in the form of security. The Chartered Bank and the Brindlays Bank have their head officers in England whereas the American Express Bank and Citi Bank have their head offices in the USA.

Commercial banks provide various services like collecting cheques bills of exchange remitting money from one place to another place etc. It mobilizes the savings of the people and makes funds available to businesses. Other types of commercial bank accounts include money market accounts and certificates of deposit.

Commercial banks are of three types ie. There are several types of deposits which are accepted by the commercial banks like Savings Deposits Current Deposits Fixed Deposits Seasonal Deposits Recurring Deposits etc. Saving Bank Account 2.

State Bank of India SBI 2. These are governed by the Indian Banking Regulation Act 1949. Barclays Bank of Zimbabwe Limited NMB Bank Limited FBC Bank Limited Banc ABC Limited Formerly ABC Bank Agri-Bank.

Examples of commercial banks in India are the State Bank of India United Bank of India ICICI Bank HDFC Bank etc. It is suitable for small savers. Commercial banks are commonly categorized into three types.

While most types of commercial lending are long-term loans that give you years to repay hard money loans count as short-term financing. There are three different types of accounts from which customers choose the most suitable account for their needs. Commercial banks are of three types which are as follows.

Few examples of commercial banks in India are as follows. There are mainly two types of loans and advances provided by commercial banks. It is necessary to understand the different types of financial institutions to explain the functions of commercial banks effectively.

Explain different types of loans and advances provided by commercial banks. A smaller amount is required to open a savings account than a fixed deposit account. Commercial banks perform the function for the public in terms of accepting profits or extending loans.

Answer There are different types of deposit accounts in commercial bank are follows Saving Accounts- An investment funds ledger is an ordinary store account where you acquire a base pace of revenue.

Organization Chart For A Commercial Bank Org Chart Organization Chart Organizational Chart

Pin On All About Ways To Save On Everything

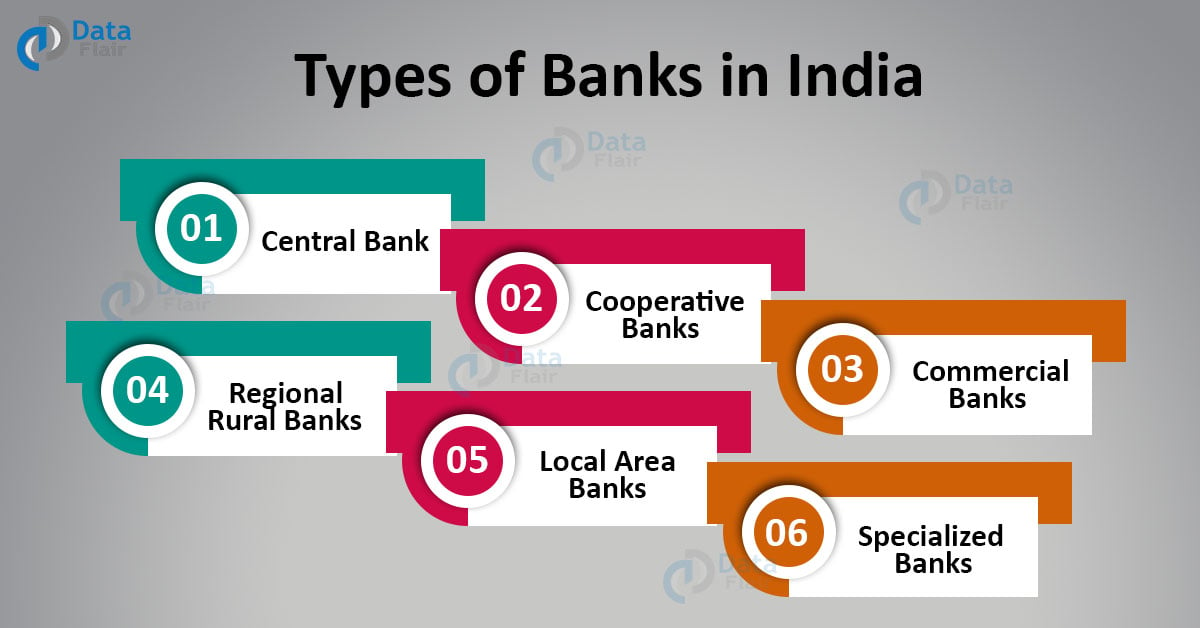

Types Of Banks In India Indian Banking Sector Dataflair

Investment Banks Can Be Split Into Private And Public Functions Read All About What Investment Banks Do At Investment Firms Investment Banking Raising Capital

Most Common Types Of Banks Personal Finance Articles Banking Institution Retail Banking

Investment Banking Vs Commercial Banking Investment Banking Investing Finance Investing

Commercial Bank What You Need To Know About Commercial Banks

Everything You Need To Know About Non Bank Loans Bank Loan Finance Loans Business Loans

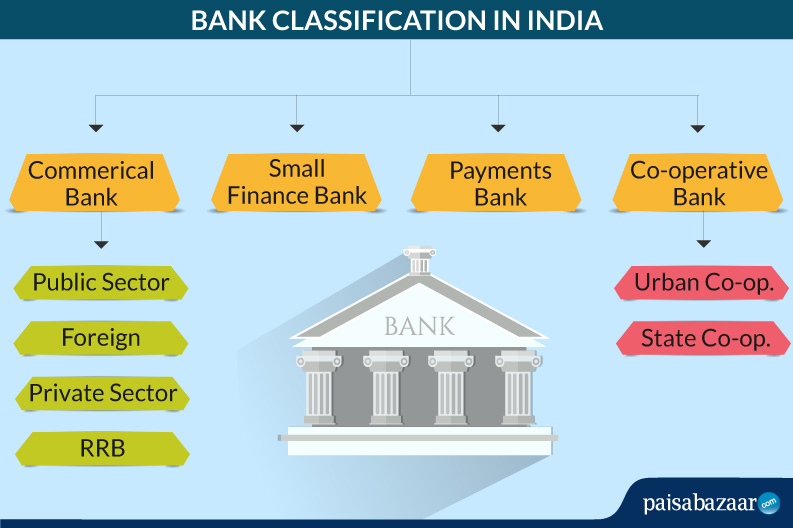

Banking In India Types Of Banks Banking Classification Paisabazaar

Investment Banking Careers Investment Banking Career Finance Career Investment Banking

Commercial Bank Definition Function Credit Creation And Significances

What Is A Bank And Different Types Of Banks In 2022 Financial Management Bank Financial Retail Banking

A Commercial Bank Is A Type Of Financial Institution That Accepts Deposits Offers Checking Account Servi Commercial Bank Business Loans Certificate Of Deposit

Top Difference Between Scheduled Banks And Non Scheduled Banks With Table National Australia Bank Demand Draft Finance Bank

Types Of Commercial Banks Commercial Banks Are The Banks Which Do The Banking Business With The Aim Of Earni Commercial Bank Commercial Public Limited Company

Difference Between Commercial Bank And Development Bank Youtube Commercial Bank Commercial Development

Investment Banking Books Scheduled Via Http Www Tailwindapp Com Utm Source Pinterest Utm Medium Tw Investment Banking Finance Investing Financial Life Hacks

Comments

Post a Comment